Request For Applications – TADAEEM Retour vers les opportunités

Échéance

01 Octobre 2020 Il y a 5 ans

Critères d'éligibilité

Cliquez ici pour parcourir les critères d'éligibilitéPartager l'opportunité sur

Détails de l'opportunité

Domaines concernées par cette opportunité: Développement économique et social

SUMMARY

USAID TUNISIA ACCOUNTABILITY, DECENTRALIZATION, AND EFFECTIVE MUNICIPALITIES (TADAEEM) SUMMARY

TADAEEM uses grants strategically to support interventions and achieve project objectives, by enable

community partnerships with local authorities to advance tangible performance improvements and

accelerate the impact of TADAEEM project outcomes.

TADAEEM uses grants to engage local CSOs/NGOs in activities that incentivize service performance

and accountability, enhance citizen participation in government, promote sustainable participation and

transparency, support identified service delivery infrastructure needs, and, at times, conduct advocacy

campaigns. More specifically, TADAEEM anticipates grants to promote participation among local CSOs

to scale up local social accountability initiatives and provide a platform for national level partners to build support for increased decentralization. Moreover, TADAEEM provides municipalities and various

service providers with in-kind grants for equipment, materials, software, ICT upgrades, etc., in support

of service delivery improvements.

TADAEEM’s teams at each of its five Regional Hubs (Tunis, El Kef, Gabes, Kairouan and Tozeur)

provides oversight and support to the process of implementation of grants activities and establishes

working relationships with target municipalities.

REQUEST FOR APPLICATION (RFA) SUMMARY

Scope of Work:

This solicitation requests applications from eligible non-governmental organizations registered in Tunisia to assist and fully engage several municipalities of various sizes (list is attached to this RFA) to update and build a database for their Decennial Surveys of private real estate holdings and business

establishments, as well as train municipal teams on the use of such database. The list below includes

two tiers of municipalities. Tier I contains the subject municipalities of this RFA. Tier II provides a list of

municipalities that TADAEEM wishes to cover as well but is dependent on available time and cost.

TADAEEM encourages applicants to submit an illustrative timeframe and cost for Tier II municipalities

as an option.

List of Municipalities

TIER 1:

- El Kef

- Siliana

- Nadhour

- Ettadhamen

- Haffouz

- El Jem

- Metouia

- Tataouine

- Tozeur

- Om Larayes

TIER 2:

- Dahmani

- Fahs

- Kairouan

- Alaa

- Ksour Essef

- Gabes

- Ghomrassen

- Kebili

- Gafsa

The applicant shall provide a detailed approach to assist and fully engage municipalities to update and

build a database for their Decennial Surveys of private real estate holdings and business establishments, including proposing use of appropriate technology and associated proprietary rights, as well as the approach to engaging with and training municipal teams. The applicant shall ensure that each municipality is fully engaged in the process and, by the end of the award, has 1) adopted and internalized the required capacities and procedures, 2) mastered the utilization of the tools and technologies for sustaining this activity, and 3) expanded its scope to cover other data collection on additional areas of revenue that fall within its mandate. The applicant will lead the process jointly with a municipal team, and closely accompany the municipality and the teams it designates to conduct this task until the task is fully completed.

Applicants should also articulate how they intend to engage municipal leadership to support: 1) the

required arrangements for the effective management of the data updating process, 2) the set-up and

management of the required database for archiving and updating data in a sustainable and efficient

manner, 3) the designation of suitable personnel to undertake this activity, and 4) transferring capacity

developed during implementation.

Applicants are also required to address and provide detailed description of the following issues in their

proposals:

- Labor requirements, logistical arrangements, and resources needed for the development of the workplan.

- The procedures, techniques, data collection and geolocation technology to be used for the collection of data, including geolocation to close any gaps in coverage or quality. The applicant is expected to consult regularly with the relevant department at the Ministry of Local Affairs (MoLA) to ensure compatibility with related information systems, notably the national application GRB (Management of Budgetary Resources).

- Technology applications used, which must be open license and able to interface and exchange data with other relevant applications

- How the proposed technology applications enable the entry of address coordinates of a given location as well as data on the layers of functions or residences that exist at that location in the case of multistory residential or multiuse buildings. Data on each layer should include area, occupant or owner, type of function.

- Proposed team of field data collectors (use of male and female university students, or others with similar or suitable profiles, is encouraged), including municipal staff to acquire on-the-job skills.

- Implementation of citizens engagement techniques, in collaboration with municipal and TADAEEM regional teams, to ensure residents of targeted zones are notified to guarantee their availability and collaboration.

- Means of data verification and quality control, and the plan to provide on-the-job training to increase the capacity of the designated personnel of each municipality on these procedures and its longer-term management.

Problem Statement:

Municipalities rely on a variety of sources of revenue to finance their investment and recurrent cost. Part

of such revenues is provided by the central government, but a significant percentage of revenues is obtained through shared as well as own sources that are earmarked for municipalities but are mostly collected on their behalf by the revenue collection branches of the Ministry of Finance (MoF). There are

three primary categories of local own-source revenue that are available to municipalities:

- A percentage of Business taxes (TCL) collected by the MoF on the range of economic activities that operate within municipal jurisdiction;

- Property tax on private real estate within the jurisdiction of the municipality whether built or vacant;

- Municipal properties or other revenue-generating assets, including:

- Economic facilities such as markets, slaughterhouses and other income-generating assets;

- Municipality owned real estate both vacant but holds revenue potential or built properties that yield rental revenue;

- Other revenue-generating sources such as air space rental for advertising, sidewalk or public space utilization fees, and others; and

- Fees and dues on permit issuance and other services offered to citizens including social registry and other transactions, which is outside the scope of the RFA.

Grant Objective:

This grant is intended to provide target municipalities with a user-friendly database that contains full

description of all municipal revenue-generating assets, and a trained municipal team capable of continuing to update data, use and maintain the data to ensure sustainability, with the ultimate objective

of increasing municipal own-revenues.

Period of Performance:

9 months from date of award. The application workplan and budget should reflect the 9-month period of

performance.

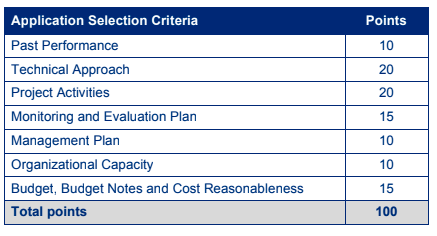

Proposal Selection:

All applications will be reviewed to check for eligibility and completeness of the submission. All eligible

and complete applications will be reviewed by a Technical Evaluation Committee (TEC) against the

review criteria described in Section 6 Selection.

The minimum score to be considered for grant funding is 70 points out of the total 100 points.

Applicants not selected for award will be notified by the project in writing.

Funding Range:

Subject to the availability of funds, TADAEEM intends to award one grant to an eligible organization of

up to the amount of USD 225,000. Funding for this grant will be subject to USAID approval, availability

of funds and demonstrated successful past performance. Funding will be disbursed to the grantees in

Tunisian Dinar.

INSTRUCTIONS FOR APPLICANTS

GENERAL

- Entities invited to submit an application are under no obligation to do so.

- Applicants will not be reimbursed by TADAEEM for any costs incurred in connection with the preparation and submission of their applications.

- Applicants may submit only one application under this RFA.

- For the purposes of interpretation of these Instructions to applicants, the periods named herein shall

be consecutive calendar days. - TADAEEM reserves the right to conduct discussions and/or to ask to make an oral presentation once a successful application is identified, or to make an award without conducting discussions based solely on the written applications if it decides it is in its best interest to do so.

- TADAEEM reserves the right not to make any award.

- These instructions to applicants will not form part of the offer or Grant Award. They are intended solely to aid applicants in the preparation of their applications.

RFA CONTACT INFORMATION

TADAEEM Office Address: HBG Immeuble 2eme étage, rue de l’ile de Failaka, cité Les Pins, Les Berges

du Lac II, Tunis,1053 – Les Berges du Lac 1 Attention: TADAEEM Grants Program

Email: grants@tadaeem.com

QUESTIONS AND CLARIFICATIONS

Method:

Only written questions and requests for clarification will receive a response. Send questions about this

RFA by email to the RFA Contact noted above.

Date for receipt:

All questions and requests for clarification must be received by September 23rd, 2020 to the email

address above. Only questions received by this date will receive a response.

Responses:

By September 24th , 6:00PM Tunis time, we anticipate providing responses to the requests for clarifications. All responses will be emailed to all applicants.

TADAEEM will conduct an informational workshop to interested Applicants to advise on the application

process and provide guidance on how to use the automated grants management portal, Fluxx. The workshop will have a webinar option for remote participation, date and time will be announced through

TADAEEM communication channels (https://www.facebook.com/TADAEEMTunisia/).

APPLICATION DUE DATE AND TIME

Closing Time: 11:59 PM Tunis time.

Closing Date: October 1st, 2020.

TYPE OF AWARD

TADAEEM anticipates the award of one standard grant in response to this RFA with the ceiling amount

of up to the amount of USD 225,000, payable in Tunisian Dinar. The grant will be on a reimbursement

basis for costs incurred according to the approved budget and paid no more than monthly by TADAEEM.

APPLICATION CONDITIONS PRECEDENT

All applications must be submitted in the specified format (see Section 4 Technical Application Contents).

Any application submitted in any other format will not be considered. The applicant must also include

other supporting documentation (board resolution, articles of incorporation, etc.) as may be necessary

to clearly demonstrate that it meets the following conditions precedent to Application Evaluation:

- That the applicant organization is an eligible organization legally constituted under Tunisian law or is in the process of obtaining such legal status through formal registration;

- That the applicant organization has the managerial commitment, as evidenced by written board of director’s resolutions, strategic plans (overall long-range plan for applicant’s organization) or other documentation, indicating that it is, or will be, implementing the objectives referred above;

- That the applicant organization has no advances from USAID or a USAID contractor which have been outstanding and unliquidated for longer than 90 days, and that the applicant organization has no grant completion report required under a grant from USAID or a USAID contractor which is more than 30 days past due;

- That at the time of application there exists no condition within the applicant organization or with respect to the applicant organization’s management which renders the organization ineligible for a grant directly or indirectly funded by USAID.

LATE APPLICATIONS

Applicants are wholly responsible for ensuring that their applications are received in accordance with the instructions stated herein. A late application will not be eligible for consideration and will be rejected

without evaluation, even if it was late as a result of circumstances beyond the applicant’s control. A late

application will be considered only if the sole cause of its becoming late was attributable to TADAEEM,

Deloitte Consulting LLP, its employees or agents.

MODIFICATION/WITHDRAWAL OF APPLICATIONS

Any applicant has the right to withdraw, modify or correct its offer after such time as it has been delivered to TADAEEM provided that the request is made before the offer closing date.

DISPOSITION OF APPLICATIONS

Applications submitted in response to this RFA will not be returned.

Applicants must submit the Application Form and present additional documentation demonstrating their qualifications and experience relevant to the requirements described in the Section 3 Statement of Work.

STATEMENT OF WORK

BACKGROUND

Municipalities are required to conduct a Decennial Survey, in adherence with Circular of the MoLA

number 4 of February 11, 2016, in coordination with the revenue collection arm of the MoF at the local

level as well as the branch of the Central Bureau of Statistics and other relevant bodies at the

governorate level.

Municipalities are also expected to update data collected through this survey annually. The latest

Decennial Survey was carried out by all municipalities over the period 2016-2017, which avails a

reasonably accurate representation of private residential and commercial properties. However, due to

capacity limitations in most municipalities for carrying out such surveys and for updating them, in addition to ineffective data collection procedures and data recording and storage techniques, the level of

accuracy and comprehensiveness of such efforts remains significantly lacking.

Under recording of private residential and commercial properties and the inaccurate documentation of

the areas they occupy results in significant underestimation and, ultimately, a lower level of revenue

collection on behalf of the municipality. Furthermore, the use of manual data recording and ineffective

methodologies for calculating the areas of residential properties and business properties further erode

the level of revenue potentials of such sources.

OBJECTIVE

This grant is intended to provide target municipalities with a user-friendly database that contains full

description of all municipal revenue-generating assets, and a trained municipal team capable of

continuing to update data, use and maintain the data to ensure sustainability, with the ultimate objective

of increasing municipal own-revenues.

ILLUSTRATIVE INDICATORS

- Number of tools developed for targeted municipalities

- Number of municipal agents trained on the use of the developed tools

- Level of increase in the efficiency of data collection and the satisfaction of municipal staff

- Number of coordination meetings organized jointly by the grantee and the municipal staff

ILLUSTRATIVE DELIVERABLES

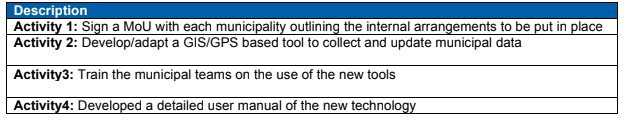

Applicants are required to provide a detailed workplan that includes a timeframe for each deliverable:

- A Municipal Agreement (per municipality) that outlines the internal arrangements to be put in place by the municipality and the applicant

- Selected GIS/GPS-based tool (software) to be used by beneficiary municipalities to collect and update data

- List of hardware required for data collection, storage and geolocation in targeted municipalities

- A plan for the on-the-job training to increase the capacity of municipal teams

- A bi-weekly project progress report

- Detailed how-to guidelines/manual on the use of provided technology in data collection and database management

ILLUSTRATIVE ACTIVITIES

KEY PERSONNEL

Project Manger

Finance Officer

Lead Technical Developer

MONITORING AND EVALUATION PLAN

The monitoring and evaluation (M&E) plan is a document that helps to track and assess the results of

the interventions throughout the period of performance of the grant activity. The M&E plan should include elements such as the logical framework, indicators as well as data collection and verification methods.

BUDGET AND PAYMENT TERMS

The grant will be on a reimbursement basis for costs incurred according to the approved budget and

paid no more than monthly by TADAEEM.

TYPES OF RECIPIENTS

U.S. and Tunisian non-governmental organizations, either for or not-for profit, legally registered in Tunisia are eligible for grant awards. U.S. organizations total grant amount limit is $100,000.

GRANT PROGRAM EXPECTED RESULTS

- MoU (per municipality) that outlines the internal arrangements put in place by the municipality and the applicant is signed

- GIS/GPS-based tool (software) is selected, in order to be used by beneficiary municipalities to collect and update data

- Municipal teams are trained in order to build their capacities for the use of the new tools

- Detailed how-to guidelines/manual on the use of provided technology in data collection and database management is prepared.

TECHNICAL APPLICATION CONTENTS

All complete applications received by the deadline will be reviewed for responsiveness to the specifications outlined in the guidelines. TADAEEM may reject applications that are:

- Incomplete;

- Do not respond to the scope of work in the solicitation;

- Do not comply with the format requirements;

- Are submitted after the deadline.

Technical Proposal (10 pages maximum)

Sections of the Attachment 1 Technical Proposal of the Grant Application Form and Guidelines should

use the headings below, in the following order.

Organizational Capacity

Provide a summary of organization’s key qualifications and capabilities. It should indicate who your organization is and what it does, and what a client can expect from your organization. Provide a brief description of your present and ongoing actions/projects that have a direct relationship to the proposed grant activity.

Past Performance

Describe the organization’s experience implementing similar projects. Describe the organization’s relationships with the target populations and demonstrated commitment to working closely with the target population to implement project activities. If your organization is a new one, describe the similar projects where your personnel participated. Provide brief information on up to three (preferably similar) actions/projects managed by your organization for which your organization has received assistance awards or contracts over the past three years in Attachment 5.

Management Plan

Describe how the project will be managed, the composition and organizational structure of the proposed project team, roles and responsibilities. Include information on technical and managerial experience of the proposed project technical personnel. Provide CVs of all proposed personnel in Annex, including the Project Manager. Experienced, qualified personnel in relevant disciplines and areas should be provided for project management and staff. CVs should not exceed two pages each.

Technical Approach / Methodology

Describe technical and strategic approaches that will be used to implement of the proposed

activities and reasons for the proposed methodology. Identify best practices and evidence

base/rationale that have informed the project interventions. If the grant activity is the

prolongation of a previous action, explain how it is intended to build on results from the previous

action.

Project Activities/ Milestones

Describe in details specific activities that will be undertaken to produce the expected results.

Describe also the activities to be implemented by target population or project partners, justifying the choice of these activities and indicating their sequence and interrelation while specifying where applicable the roles of each partner.

Budget, Budget Notes and Cost Reasonableness

For budget part please follow instructions given in Attachment 1 Budget and Budget Notes of

the Grant Application Form and Guidelines.

BUDGET CONTENTS

BUDGET AND PAYMENT TERMS

The approximate budget for the grant is up to the equivalent of USD 225,000 in TND. The budget items

and associated payment terms and dates will be finalized based on the Applicant’s proposal and fixed

in the Grant Award document.

Budget Content

The Applicant must:

- Include a detailed and realistic budget using the template provided (see Attachment 2). The budgets must be prepared in local currency (TND) and should be based on activities described in the Technical Proposal. Budgets should not include costs that cannot be directly attributed to the activities proposed.

- Supporting documentation to support cost data is required.

- All bidders must have the financial and administrative systems to adequately account for the grant funds as detailed in the extensive attachments and referenced US Government websites

- Present all amounts in TND and without decimal places. Awards will be paid out in local currency via bank transfer.

Budget Notes

The purpose of budget notes is to help TADAEEM Technical Evaluation Committee better understand

the organization’s budget, specifically the rationale for unit costs and quantities. Use template to guide

the development of your budget notes included to Grant Application form. Add additional information as necessary to clarify your budget inputs.

COST SHARE

Applicants are expected to cost share the implementation of the proposed grant activity by minimum of

5 percent of the total cost of the grant activity.

Cost share contribution may be financial or in-kind and include any of the following:

- Labor to carry out grant activities;

- Payment of non-labor costs associated with grant activities;

- Leveraged funds from other sources (non-US government);

- Equipment and facilities;

- In-kind donations (include labor, volunteer labor, office space, conference space etc.).

All costs shared by the applicant (both financial and in-kind) must meet all of the following criteria:

- Be verifiable in the applicant records;

- Necessary and reasonable for proper and efficient accomplishment of grant activity objectives;

- Allowable under the applicable USAID regulations (see Attachment 4);

- Must not be included as cost share contributions for any other U.S. Government-assisted program;

- Must not be paid by the U.S. Government under another grant or agreement.

Sub-awards will not be allowed under TADAEEM.

TAXES

Recipients must comply with project requirements regarding VAT/service tax reporting for applicable

VAT/service tax to be reimbursed.

SELECTION

TADAEEM intends to award grants resulting from this solicitation to the responsible Grantees whose

Application conforms to the solicitation and represents best value solutions after selection in

accordance with the criteria/factors listed here.

The review criteria below are presented by major category so that Applicants will know which areas require emphasis in the preparation of Applications.

Technical: TADAEEM will evaluate each technical approach quantitatively based upon the selection

factors set forth above. A technical proposal can be categorized as unacceptable when it is incomplete,

does not respond to the scope, does not comply with the format requirements or is submitted after the

deadline.

Budget: The proposed budget will be analyzed as part of the Application selection process. Applicants

should note that Budgets must be sufficiently detailed to demonstrate reasonableness and

completeness, and that Applications including budget information determined to be unreasonable,

incomplete, or based on a methodology that is not adequately supported may be judged unacceptable.

Reasonableness: TADAEEM will make a determination of reasonableness based on TADAEEM’s

experience for similar items or services, what is available in the marketplace, and/or other competitive

offers.

Completeness: A detailed line item budget, budget notes, assumptions, and schedules that clearly

explain how the estimated amounts were derived must adequately support the Applicant’s budget.

TADAEEM may request additional supporting information to the extent necessary to determine whether

the costs are fair and reasonable.

REFERENCES, TERMS & CONDITIONS

REFERENCES

- The U.S. Government regulations that govern this grant as found at the following websites:

http://www.usaid.gov/sites/default/files/documents/1868/303.pdf

https://www.acquisition.gov/far/html/FARTOCP31.html

https://www.ecfr.gov/cgi-bin/text-idx?tpl=/ecfrbrowse/Title02/2cfr200_main_02.tpl. - Required provisions for Simplified and Standard Grants to Non-U.S. Non-Governmental

Organizations: http://www.usaid.gov/ads/policy/300/303mab

TERMS AND CONDITIONS

- Issuing this RFA is not a guarantee that a grant will be awarded.

- Deloitte reserves the right to issue a grant based on the initial selection of offers without discussion.

- Deloitte may choose to award a grant for part of the activities in the RFA.

- Deloitte may choose to award a grant to more than one Recipient for specific parts of the activities in the RFA.

- Deloitte may request from short-listed grant a second or third round of either oral presentation or written response to a more specific and detailed scope of work that is based on a general scope of work in the original RFA.

- Deloitte has the right to rescind an RFA or rescind an award prior to the signing of a contract due to any unforeseen changes in the direction of Deloitte’s client (the U.S. Government), be it funding or programmatic.

- Deloitte reserves the right to waive any deviations by organizations from the requirements of this solicitation that in Deloitte’s opinion are considered not to be material defects requiring

Grant Agreement

A grant agreement will include the approved project description, approved budget, payment terms,

reporting requirements and relevant provisions. Once executed it is a legally binding agreement between Deloitte (on behalf of the TADAEEM project) and the Recipient organization. Once the grant agreement

is signed, it cannot be modified without prior written approval from Deloitte (on behalf of the TADAEEM project).

Grant Disbursement and Financial Management

The grants will be disbursed in Tunisian Dinar and transferred only through bank transactions.

Reporting

The grant agreement will detail the reporting requirements. Recipients must be willing to adhere to the

reporting schedule and requirements for both programming activities and financial monitoring.

Monitoring

TADAEEM staff will monitor programmatic performance. Deloitte and USAID reserve the right to review finances, expenditures and any relevant documents at any time during the project period and for three years after the completion of the project and closeout. All original receipts must be kept for three years after the formal closeout has been completed.

Late Submissions, Modifications and Withdrawals of Applications

At the discretion of Deloitte, any application received after the exact date and time specified for the

receipt may not be considered unless it is received before award is made and it was determined by

Deloitte that the late receipt was due solely to mishandling by Deloitte after receipt at its offices.

Applications may be withdrawn by written notice via email received at any time before award.

Applications may be withdrawn in person by a vendor or his authorized representative, if the representative’s identity is made known and the representative signs a receipt for the application before

award.

False Statements in Offer

Vendors must provide full, accurate and complete information as required by this solicitation and its

attachments.

Certification of Independent Price Determination

(a) The offeror certifies that–

(1) The prices in this offer have been arrived at independently, without, for the purpose of

restricting competition, any consultation, communication, or agreement with any other offeror,

including but not limited to subsidiaries or other entities in which offeror has any ownership or

other interests, or any competitor relating to (i) those prices, (ii) the intention to submit an offer,

or (iii) the methods or factors used to calculate the prices offered;

(2) The prices in this offer have not been and will not be knowingly disclosed by the offeror,

directly or indirectly, to any other offeror, including but not limited to subsidiaries or other entities

in which offeror has any ownership or other interests, or any competitor before bid opening (in

the case of a sealed bid solicitation) or contract award (in the case of a negotiated or competitive

solicitation) unless otherwise required by law; and

(3) No attempt has been made or will be made by the offeror to induce any other concern or

individual to submit or not to submit an offer for the purpose of restricting competition or

influencing the competitive environment.

(b) Each signature on the offer is considered to be a certification by the signatory that the signatory–

(1) Is the person in the offeror’s organization responsible for determining the prices being offered

in this bid or application, and that the signatory has not participated and will not participate in

any action contrary to subparagraphs (a)(1) through (a)(3) above; or

(2) (i) Has been authorized, in writing, to act as agent for the principals of the offeror in certifying

that those principals have not participated, and will not participate in any action contrary to

subparagraphs (a)(1) through (a)(3) above; (ii) As an authorized agent, does certify that the

principals of the offeror have not participated, and will not participate, in any action contrary to

subparagraphs (a)(1) through (a)(3) above; and (iii) As an agent, has not personally participated,

and will not participate, in any action contrary to subparagraphs (a)(1) through (a)(3) above.

(c) Offeror understands and agrees that —

(1) violation of this certification will result in immediate disqualification from this solicitation

without recourse and may result in disqualification from future solicitations; and

(2) discovery of any violation after award to the offeror will result in the termination of the award

for default.

Standard Provisions

Deloitte is required to respect the provisions of the United States Foreign Assistance Act and other

United States laws and regulations. The TADAEEM Grant Program will be administered according to

Deloitte’s policies and procedures as well as USAID’s regulations for Non-U.S. Governmental Recipients

or USAID’s regulations for U.S. Non-Governmental Recipients. These include:

1. Implementing Partner Notices (IPN) registration

Applicant acknowledges the requirement to register with the IPN portal if awarded a grant resulting from this solicitation and receive universal bilateral amendments to this award and general notices via the IPN portal. The IPN Portal is located at https://sites.google.com/site/usaidipnforassistance/

2. Indirect rates

Indirect rates such as fringe, overhead, and general and administrative (G&A) that have not been

approved by a U.S. Government agency in a NICRA (Negotiated Indirect Cost Rate Agreement)

may not be charged to this award. All costs charged to the project shall be directly related to the

project’s implementation.

3. Activities that will not be considered for funding

In keeping with the conditions above, programs that fall within the following categories or indicate

they might participate in any one of the following shall be automatically disqualified:

• Activities related to the promotion of specific political parties.

• Reconstruction or building rehabilitation projects that are not accompanied by plans for wide

community use and maintenance.

• Distribution of emergency/humanitarian assistance or funds.

• Religious events or activities that promote a particular faith.

• For-profit business activities that benefit a small select group, rather than providing

increased opportunities to the larger community.

• Unrelated operational expenses.

4. Prohibited Goods and Services

Under no circumstances shall the Recipient procure any of the following under this award, as these

items are excluded by the Foreign Assistance Act and other legislation which govern USAID funding.

Programs which are found to transact in any of these shall be disqualified:

• military equipment;

• surveillance equipment;

• commodities and services for support of police or other law enforcement activities;

• abortion equipment and services;

• luxury goods and gambling equipment; and

• weather modification equipment.

5. Restricted Goods

The following costs are restricted by USAID and require prior approval from Deloitte and USAID:

• agricultural commodities;

• motor vehicles;

• pharmaceuticals;

• pesticides;

• fertilizer;

• used equipment; and

• U.S. Government-owned excess property

6. Certifications for Non-US Non-Governmental Recipients

The following Standard Grant & Subcontractor Certifications are required by Deloitte and USAID:

• Assurance of Compliance with Laws and Regulations Governing nondiscrimination in

Federally Assisted Programs (This assurance applies to Non-U.S. Governmental

Organizations, if any part of the program will be undertaken in the U.S.);

• Certification Regarding Lobbying (22 CFR 227);

• Prohibition on Assistance to Drug Traffickers for Covered Countries and Individuals (ADS

206, Prohibition of Assistance to Drug Traffickers);

• Certification Regarding Terrorist Financing;

• Certification of Recipient;

• Compliance with Anticorruption Laws.

• A completed copy of Representation by Organization Regarding a Delinquent Tax Liability

or a Felony Criminal Conviction; and

• Certification Regarding Trafficking in Persons

Critères d'éligibilité

- Language: The application and all associated correspondence must be in English or in French. Any award document resulting from this request will be in English.

- Currency: The cost must be presented in Tunisian Dinar.

- Method: TADAEEM Grants Portal Submission, email or hard copy.

- Marking: USAID Tunisia Accountability, Decentralization, and Effective Municipalities (TADAEEM), RFA – Improving Municipal Revenue

- Authorized Signer: Application must be signed by a person duly authorized to submit an Application on behalf of the applicant and to bind the applicant to the Application.

- Authorized Personnel: Provide name, title, email, and telephone number of the person or persons in the entity who are authorized to discuss and accept a grant, if awarded.

- U.S. and Tunisian for profit or non-profit non-Governmental organizations legally registered in Tunisia are eligible organizations for grant awards.

- The organization must have at least 2 years’ experience;

- The organization must have demonstrated experience in technical areas relevant to the scope of work or grant focus;

- The organization must currently be implementing activities in the geographic area and technical area for which it is submitting an application;

- The organization has minimum absorptive capacity and demonstrates the potential to acquire sufficient capacity to manage programs in a sustainable manner;

- The organization has a functional financial system;

- The organization’s other relationships, associations, activities, and interests do not create a conflict of interest that could prevent full impartiality in implementation of the grant activities;

- DUNS and SAM numbers are required for all organizations, foreign or domestic doing business with the Federal Government. Recipients of grant awards in excess of $25,000 will be required to obtain a Data Universal Numbering System (DUNS) Number.

L'opportunité a expiré

Cette opportunité n'est malheureusement plus disponible sur Jamaity. Visitez régulièrement la rubrique opportunités pour ne plus en rater.

Contacts

Suivez Jamaity sur LinkedIn

Obtenez Jamaity Mobile dès maintenant

Appel à candidatures Publié sur Jamaity le 22 septembre 2020

Découvrez encore plus d'opportunités sur Jamaity en cliquant sur ce lien.