Mercy corps lance un appel à consultation pour le “Project Audit (September 01, 2018 – April 30, 2019) of Mercy Corps Grant SB-007024 (OCHA Libya) – Humanitarian Analysis/Access Team” عودة إلى الفرص

Mercy Corps

يطلق Appel à candidaturesانتهاء الصلاحية

02 سبتمبر 2019 Il y a 7 ans

شارك الفرصة على

تفاصيل الفرصة

Office Address: Address: Villa Jasmin – Rue du Lac Tiberiade – 1053 Les Berges du Lac 1, Tunis, Tunisia

Tel: +216 71 861 824

Web: www.mercycorps.org

Portland Office Address: 45 SW Ankeny St. Portland, Oregon 97204

Tel 503.896.5000

Fax 503.896.5011

Web: www.mercycorps.org

Background

The Humanitarian Analysis / Access Team (HAT) – Libya

The Humanitarian Analysis team will, through the identification of localized sectoral humanitarian needs, provide additional, current, and contextual analysis that will allow for improved targeted humanitarian responses to Libya. Furthermore, the information gathered will allow for improved triangulation of existing information, as well as, strengthen the understanding of humanitarian access constraints. Based on this information those working on access will be able to devise access strategies, both among the UN and NGO community.

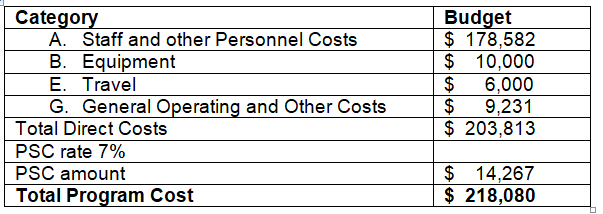

Program Budget

The Program budget is categorized under following expense categories.

Table 1: Categorized Program Budget

Focal Persons:

The focal persons for Mercy Corps at Portland Office are:

Jamey Pietzold

Senior Finance Officer

45 SW Ankeny St. Portland,

Oregon 97204

Tel 503-896-5000

Fax 503-896-5011

Web: www.mercycorps.org

Email: jpietzold@mercycorps.org

Craig Redmond

Vice President, Programmes,

45 SW Ankeny St. Portland,

Oregon 97204

Tel 503-896-5000

Fax 503-896-5011

Web: www.mercycorps.org

The focal persons for Mercy Corps at Tunisia / Libya Office are:

Mickael Amar

Country Director,

Mercy Corps Tunisia / Libya

Emai: mamar@mercycorps.org

Hassan Morajea

Humanitarian Access Advisor – Libya

Mercy Corps Tunisia / Libyia

Email: hmorajea@mercycorps.org

Josephine Savarino

Finance Manager

Mercy Corps Tunisia / Libya

Email: jsavarino@mercycorps.org

Accounting Standards

Mercy Corps in Tunisia / Libya follows a modified cash basis and aligns with all International Financial Reporting Standards issued by IASB.

Reporting Standards

The project statement of income and expenditure and the financial report are the formats according to donor requirements and include:

- Project Level

- Financial Statements

- Statement of Income & Expenditure

- Notes to the stmts

- Final Financial Report Verification

- Notes to the Final Financial Report

- Statement of Income & Expenditure

- Financial Statements

Available Facilities

The Auditors will have complete access to all books of accounts/record/programmatic reports within Tunisia and Libya as requested. A limited number of transactions are processed in Mercy Corps head office. This includes expatriate staff salary and benefits. MC will facilitate the auditor to carry out their work in the best possible conditions. These conditions will include the availability of a room/office, access to office equipment such as a photocopier, telephone line and internet connection, to the extent to which this is possible.

Audit Scope

Scope of Work

This is the audit of the Humanitarian Analysis / Access Team (HAT) – Libya Award, the audit will be performed in light of the scope of the work indicated below;

- The external audit will be performed in accordance with IFAC International Standards on Auditing and local laws as applicable to Mercy Corps.

- The reports should contain proper explanatory notes. Additionally, they should provide the variance with summary budget vs expenditure reported.

- A sufficient sample determined by the audit firm of Mercy Corps expenditure and support documentation related to the above-mentioned award will be audited

- The Audited period will be from September 01, 2018 to April 30, 2019, also known as the period of award.

- Sufficient Audit evidence will be collected to verify the statement of source and utilization of Funds. The supporting information to the statement of source and use of funds should be in English.

- The auditor should state in the audit report if above conditions are not followed, is such case the audit report shall reflect the alternative standards followed during the audit.

General Procedures.

At the minimum, the following procedures should be covered by the Auditor performing the review:

- The scope of the audit will include gathering sufficient evidence to determine that the balance indicated as being on hand in the records is accurately accounted for in Mercy Corps fund accounting financial system.

- Obtain a sufficient understanding of the project and of the Terms and Conditions of the Grant Agreement. Mercy Corps will provide the Auditors with all grant agreement(s) and relevant documents.

- Review the Terms and Conditions of the Grant Agreements which have direct, pre-grant and post-grant agreement financial impact for the project under review and ensure compliance under the provisions of the Grant Agreement, and any amendments thereto;

- Verify that the Financial Reports and annexure(s) as applicable thereto comply with the conditions of the Grant Agreement.

- Examine whether Mercy Corps has complied with IFRS, MC Field Finance Manual and the Grant Agreement provisions (if any).

- The purpose of the audit is to: give an opinion about whether there is an efficient and effective internal control system in place and the financial statements give true and fair view of the state of affairs; to report material exceptions and weaknesses with regard to accounting, record-keeping and documentation requirements.

- Review/Reconcile the information in the Financial Reports submitted to donors and in Mercy Corps financial accounting system and records (such as Navigator).

- Perform analytical review of expenditure headings/groupings/sector in the Financial Report.

- Perform expenditure verification to ensure that expenditures claimed by Mercy Corps are provided with supporting evidence, eligible, accurately and properly recorded, properly classified, and reported only once. Eligibility refers to the incurrence of costs in accordance with the terms and conditions of the Grant Agreement and that these costs are necessary for carrying out the project. In other words, the expenditure for a transaction has been incurred for its intended purpose and necessary for the activities and objectives to which the project is funded. The Auditor will further verify that the direct costs are: i) provided for in the budget and comply with sound financial management during the implementation of project as defined in the approved project proposal; ii) are recorded in the accounts of Mercy Corps; and iii) are identifiable, verifiable and substantiated by originals of supporting evidence.

- The Auditor will verify that the expenditure for a transaction has been accurately and properly recorded in the Mercy Corps accounting systems and the Financial Report is supported by appropriate evidence and supporting documents.

- The Auditor, exercising their professional judgment, will obtain sufficient appropriate verification evidence as to whether the expenditure has occurred (reality and quality of the expenditure) and – where applicable – assets exist. The Auditor will verify the reality and quality of the expenditure for a transaction by examining proof of work done, goods received or services rendered on a timely basis, at acceptable and agreed quality and at reasonable prices or costs; and, if applicable, ascertain hand-over of intended goods or services to beneficiaries were made.

- The Auditor will report all exceptions found including weaknesses in internal control system (Management Letter). The auditor will also provide recommendations in the management letter for improvements of the weak points.

The Audit Report

The Audit report must be in conformity with International Standards on Auditing (ISAs as adopted and applicable in Tunisia / Libya). All reports should be presented in English. Minimum of at least the following should be reported.

Accounting standards that have been applied and indicate the effect of any deviations from those standards.

The audit standards that were applied either ISAs or national standards that comply with one of these in all material respects.

The period covered by the audit report and audit opinion.

Whether the financial statements and supporting schedules fairly present the cash receipts and expenditure for the program and that the project funds were used for the purposes defined by the funding agreement(s).

Sample audit report is as under:

Sample Audit Report

Auditor’s report to:

Mickael Amar, Country Director

Mercy Corps Tunisia/ Libya

RE: Project SB-007024 (OCHA Libya) Humanitarian Analysis/ Access Team

We have audited the accompanying Final Financial Report Statement of the Project SB-007024 (OCHA Libya) – Humanitarian Analysis/ Access Team, September 01, 2018 – April 30, 2019. This financial report statement is the responsibility of the Program management.

Our responsibility is to express an opinion on the accompanying statement based on our audit. We conducted our audit in accordance with (either International Standards on Auditing promulgated by the International Federation of Accountants or Auditing Standards promulgated by the International Organization of Supreme Audit Institutions). These standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management as well as evaluating the overall statement presentation. We believe our audit provides a reasonable basis for our opinion.

The ABC Program management’s policy is to prepare the accompanying statements on the cash receipts and disbursements basis in conformity with IFRS. On this basis cash receipts are recognized when received and cash expenditures are recognized when paid rather than when incurred. In our opinion, the accompanying statement referred to above gives a true and fair view of (or presents fairly, in all material respects) the cash receipts and disbursements of the program during September 01, 2018 – April 30, 2019, the duration of the program in accordance with (either International Public Sector Accounting Standard XX or the National Accounting law of 19XX of XYZ Country), described in Note X.

Our audits were conducted for the purpose of forming an opinion on the special purpose financial statement taken as a whole. [Use the following section as required] The accompanying special purpose Schedule of Funding Source Reconciliation and Schedule of Major Contractual Amounts Outstanding September 01, 2018 – April 30, 2019, are presented for purposes of additional analyses and are not required parts of the special purpose financial statement. Such information has been subjected to the auditing procedures applied in the audits of the special purpose financial statements and in our opinion is fairly stated in all material respects in relation to the special purpose financial statements taken as a whole.

Date: AUDITOR’S SIGNATURE

Qualifications of an Auditor

Registered CPA and Chartered Accountancy firms are entitled to apply for this assignment.

Moreover, the Auditor should comply with the Code of governance for Professional Accountant, which includes independence requirement of the auditor and any applicable local laws. The CVs of staff involved in the Audit must be provided to MercyCorps. Audit team only be changed through mutual consent of MC and the auditor Firm, replacing staff with another person must be similar level of qualification and experience.

Management Letter

The Auditor will submit a management letter at the completion of audit which shall includes the followings:

- The effectiveness of the system in providing the program management with useful and timely information for the proper management of the program.

- The general effectiveness of the internal control system in protecting the resources of the program.

- Description of any internal control weaknesses noted in the financial management of the program.

- Recommendations to eliminate weaknesses in the internal control system.

Internal Control Memorandum- [ICM]

The auditor would provide an assessment of the program’s current internal control system with emphasis on the following:

- Effectiveness of the design of the internal control policies and procedures

- Continuity of operation through out the period under audit

- Effectiveness of the system in providing the program management with useful and timely information for the efficient management of the programme

- General effectiveness of the internal control system in safeguarding of the assets and resources of the program

- A description of any specific internal control weaknesses noted in the financial management of the programme

Note: We do not expect the external auditor to conduct a special assignment on the review of the internal control structure however any weaknesses in the design of the internal control structure would be separately reported in the form of Internal Control Memorandum. The format of the ICM should be designed in a manner to specifically report the following:

- Observation noted

- Risk involved

- Recommendation

- Management Comments

Sample of Management letter is provided as under:

Name of Prime Recipient) – MANAGEMENT LETTER FOR THE AUDIT OF FINANCIAL STATEMENTS FOR THE AWARD ENDED ……..(Insert award end date)

(Background information is provided on the applicable auditing framework that was employed in auditing the Award Financial Report Statement, for which there is this management letter)

(The purpose of the Award Financial Report Statement audit should be stated here which is the expression of an opinion on the Award Financial Report Statement. Also, a brief description of the methodology used in carrying out the audit as regards the use of testing as the basis for examining evidence supporting the amounts and disclosures contained in the Award Financial Report Statement, inter-alia.)

(An explanation of the purpose of the management letter should be provided in terms of the value-added in its provision to management for the improvement of systems and processes for the organization, thereby aiding the achievement of broader organizational goals)

(A description of system of grading of the management letter issues or findings should be provided in order that the Prime Recipient is able to better priorities implementation of recommendations emanating from findings. The following system of grading is recommended.

Grade 1 findings are those which are particularly significant and the involvement of management may be required for their resolution. These are high level issues which impact seriously on the achievement of overall grant goals

Grade II findings are those that may have significant impact on the control environment. Here control environment looks at risk factors derived from management’s attitude to risk as regards operational activities within the awardee’s organization.

Grade III findings are those which are less significant than Grade 1 and II but nevertheless merit attention. 1.0 (Brief heading for finding) (Grade 1, 2 or 3 as is applicable) {Where there is a criteria (or criterion as the case may be) which is the object of non-compliance by the awardee, then this must be stated or quoted where applicable. A criteria is defined as any law, policy, regulation or framework that an audited entity has to comply with in carrying out its activities. A deviation or complete non-compliance of it would trigger a finding. In some instances, criteria would not be present hence it would not be necessary to state it here}

FINDING

{The condition or issue presently obtaining which could have been as a result of non-compliance of criteria is stated here fully. This must be consistent with the grading level indicated above. Where possible, the reason(s)/rationale for the non-compliance to the criteria or factors responsible for the finding issue should be stated in a separate paragraph or section under FINDING}

IMPLICATION

{The effect of the finding both from a financial and non-financial perspective should be clearly stated here as this will provide better insights to the Prime Recipent entity in formulating a robust management response and action plan for implementation of recommendations.}

RECOMMENDATION

{Practical recommendations relevant to the findings stated in 1.1 above should be put in this category. Recommendations should be capable of eliminating or reducing the effects identified in 1.2 above (to an acceptable level) such that there will be no negative material impact on grant implementation upon its initiation by Prime Recipient management}

BENEFITS

The advantages of implementing the recommendations stated in 1.3 above should be highlighted here from a financial and non-financial perspective. The use of financial data in terms of for example, cost savings, should be stated here}

MANAGEMENT’S RESPONSE

{The Prime Recipient will unequivocally state the extent to which they agree or disagree with the finding indicated above. This should extend further to whether they agree or disagree with all the other elements to the management letter.

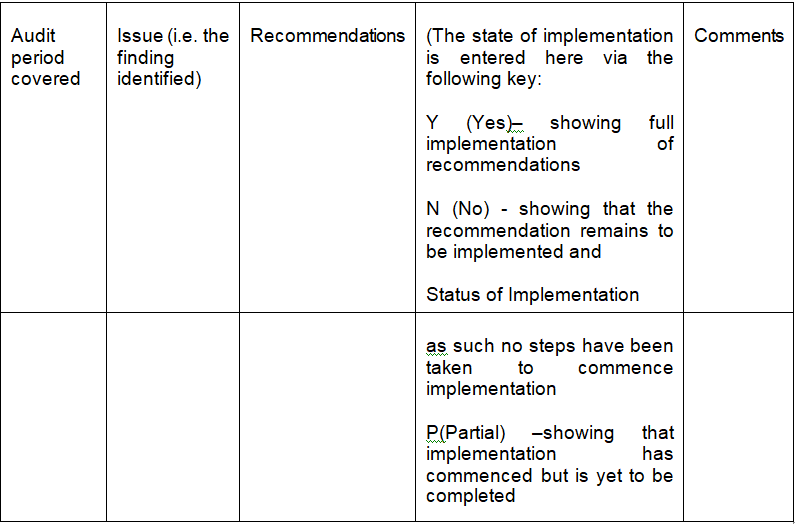

The Management letter should also include a matrix highlighting the issues from the previous audits. Sample is as under:

Place of Audit

The Audit will be conducted in Mercy Corps, Villa Jasmin – Rue du Lac Tiberiade – 1053 Les Berges du Lac 1, Tunis, Tunisia.

Finalization of Audit

The Final Audited Financial Report Statement should be submitted along with Management Letter to Mercy Corps by 21 September 2019.

The Contracting Authority reserves the right to reduce by 2% of the contract amount per day of delay in submission of reports. The agreement must be signed with in two days of selection of Audit Firm and the audit firm should start the audit with in two days of signing of contract.

انتهت صلوحية الفرصة

للأسف هذه الفرصة لم تعد موجودة على جمعيتي . زوروا بانتظام قسم الفرص لتجنب افلات الفرص اللاحقة

للاتصال

تابع "جمعيتي" على لينكد إن

احصلوا على جمعيتي موبايل من الآن

دعوة للترشّح منشور على "جمعيتي" في 28 août 2019

إكتشف المزيد من الفرص على "جمعيتي" عبر النّقر على هذا الرّابط.